Please feel free to use this for your classes. Just acknowledge my name. Thanks!

Auctions:

I am going to concentrate on one topic rather than doing a survey of the extensive literature that exists for this topic. You can see that many types of auctions exist, look here:

http://en.wikipedia.org/wiki/Auction

There are many topics here that are of interest for both serious theoretical and empirical research:

What are the optimal bidding strategies for each type of auction? How does it depend on the information that the bidders have about a. the value of the item, b. the value that other sellers place on the item and c. the real-time bidding process of the auction?

How do prices in the auction market deviate (or not) from competitive prices or oligopoly prices?

What is the role of signaling in auction markets? How do bids convey information to other potential buyers?

We will look at only one problem:

Assume only one object is being auctioned. The format is sealed-bid first price auction, the winner gets the object and pays his bid “b”. If the value of the object to him is v, he gains v-b if he wins, and zero if he does not win.

If there are two bidders, and they value the same object v1 and v2 respectively, and if there is perfect information, and v1 > v2, bidder 1 would bid v2 + e, when e is a very small number and bidder 2 will bid v2. Of course 1 would win and have a gain of v1 – v2 .

The problem becomes interesting if we assume that there are two bidders, but they do not know each other’s valuations. Without losing generality, we assume that ti is valuation of type i, and ti is known to be uniformly distributed over [0,1].

In a Bayesian Nash equilibrium, what would be the equilibrium bidding strategy of ti ? This is the question we answer:

If ti wins by bidding b, he gets ti – b if his bid is higher than the other bid, otherwise he gets zero.

Therefore, ti’s expected profit from bidding an amount b is

Πi = (t-b) prob(bj < b)

We manipulate the term prob(bj < b) a little bit. Assume that a player with valuation t will have an equilibrium bid b*(t). Since the game is symmetric, both players will use the same bidding strategy in equilibrium. Further, the function b*(t) is monotonically increasing, which means higher t will induce a higher bid in equilibrium.

Therefore prob(bj < b) = prob(b*(tj) < b) = prob( tj < ϕ(b)) when ϕ(b) = inverse of b*(t).

But then prob( tj < ϕ(b)) = ∫ ϕ(b) xdx = ϕ(b), because of our assumption of uniform distribution of valuations.

So, in equilibrium, player “i” with valuation ti will maximize

Πi = (ti-b) prob(bj < b) = (t-b) ϕ(b), by choosing his bid b

Therefore the first order-condition, described below will be met for every t

∂ Πi /∂b = 0 = – ϕ(b) + (t-b) dϕ/db = 0

So, every t will bid according to above and in equilibrium every t will follow his equilibrium bidding strategy which implies that b= b*(t) or t = ϕ(b*)

Therefore, for any b* we will have

– ϕ(b*) + (ϕ(b*) –b*) dϕ(b*)/db = 0

Since every b* will satisfy the above, we may think of this as a simple differential equation in b

A note on differential equations:

Solution of a differential equation:

-y + (y-x)dy/dx = 0

Rewrite as

-ydx –xdy + y dy = 0

Or

(ydx + xdy) = ydy

Define a change of variables

Let z = xy, then dz = xdy + ydx

So we have, dz = ydy or taking integrals on both sides

z = y2/2 or xy = y2/2 or y = 2x (done)

Finally we apply this to get ϕ(b*) = 2b or b = ϕ(b*)/2

Or b*(t) = t/2

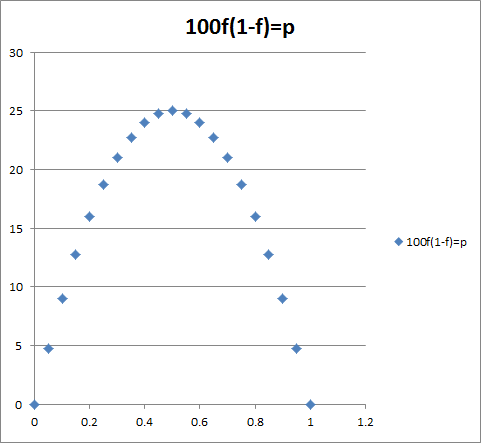

So every player, regardless of his own valuation, will bid half of his valuation in this game.

So, for example, expected profit of someone with valuation 75c will be

Profit = (3/4 – 3/8) prob(t < 3/8) = (3/8) (3/8)